How to Make the Most of PhilHealth Contributions for Job Seekers

Introduction to PhilHealth and its Importance for Job Seekers

Job hunting can be a daunting task, filled with uncertainty and challenges. Amidst the stress of searching for your next opportunity, understanding your health coverage shouldn’t add to your worries. This is where PhilHealth comes into play—a crucial safety net that every job seeker should consider. Knowing how to navigate its benefits could make all the difference during this transitional phase in life.

PhilHealth, or the Philippine Health Insurance Corporation, serves as a national health insurance program designed to provide financial protection against medical expenses. For job seekers, it’s more than just a policy; it’s peace of mind knowing you have access to healthcare even when you’re in between jobs.

Curious about how much is PhilHealth contribution for unemployed individuals? Let’s dive deeper into what PhilHealth has to offer and how you can leverage its benefits while navigating the job market!

What is PhilHealth?

PhilHealth, or the Philippine Health Insurance Corporation, is a government agency dedicated to enhancing healthcare access for Filipinos. This program aims to provide financial protection against medical expenses.

Established in 1995, PhilHealth plays a crucial role in promoting health equity. It offers various insurance packages tailored to different demographics, including employed individuals and those without jobs.

For job seekers, understanding PhilHealth is essential. It serves as a safety net during times of unemployment or financial instability. Members can avail themselves of hospitalization benefits and outpatient care services.

With this system in place, many people find peace of mind knowing that their health needs are covered even when they’re not actively employed. It encourages proactive healthcare management among its members.

Benefits of PhilHealth for Job Seekers

PhilHealth offers vital support for job seekers navigating the uncertainties of employment. One significant advantage is access to affordable healthcare services. When you’re between jobs, medical expenses can mount quickly, but PhilHealth helps alleviate those costs.

Another benefit lies in preventive care programs. Regular check-ups and screenings are essential for maintaining health, especially when one’s stress levels rise due to job hunting.

Moreover, PhilHealth provides maternity benefits that extend beyond traditional employees. This coverage is crucial for those planning families during transitional career phases.

Having PhilHealth contributes to peace of mind. Knowing you have protection against unexpected health issues allows you to focus on your job search without constant worry about potential medical bills hanging over your head.

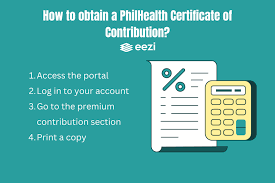

How to Register for PhilHealth

Registering for PhilHealth is a straightforward process. First, visit the nearest PhilHealth office or access their website. You’ll need to fill out the Member Registration Form (MRF), which can be downloaded online.

Prepare essential documents such as your valid ID and proof of residency. If you’re registering as an unemployed individual, ensure you indicate this status on your application form.

Once you’ve completed these steps, submit your MRF along with the required documents at the designated office. The staff will assist you if any questions arise during registration.

After processing, you’ll receive a PhilHealth Identification Number (PIN). Keep this number safe; it’s crucial for accessing benefits in the future. Remember that maintaining accurate information is key to enjoying uninterrupted health coverage while job hunting.

Steps to Avail of PhilHealth Benefits

To avail of PhilHealth benefits, start by ensuring you have an active membership. Regular contributions are crucial for eligibility.

Next, gather all necessary documents. This may include your PhilHealth ID, valid identification, and medical records if applicable. Having everything in order will streamline the process.

Visit a nearby accredited healthcare facility or hospital to access services. Present your PhilHealth ID along with other required documents at the registration desk.

Once admitted or when seeking outpatient care, inform staff that you’re using your PhilHealth benefits. They will guide you through any additional paperwork needed for billing purposes.

Remember to keep track of your claims and follow up if there are delays. Staying proactive ensures you receive the full advantages of what you’ve contributed to over time.

Tips on Maximizing PhilHealth Contributions

Maximizing your PhilHealth contributions can significantly enhance the benefits you receive. Start by ensuring that you’re contributing consistently, even if you’re currently unemployed. This not only keeps your coverage active but also helps build a stronger foundation for future claims.

Consider exploring voluntary membership options if you don’t have an employer to contribute on your behalf. This allows you to maintain continuous coverage and enjoy services when needed.

Stay informed about the different programs offered under PhilHealth. Familiarize yourself with how various packages work, as this knowledge will help in planning your healthcare needs effectively.

Keep all documentation organized and readily available. Whether it’s receipts or medical records, having everything at hand can expedite any claim process down the line.

Conclusion

Navigating the world of job searching can be daunting, but understanding PhilHealth and its contributions makes it a bit easier. For job seekers, having access to healthcare is crucial. Your health should never take a backseat during your search for employment.

PhilHealth provides essential benefits that can protect you from unexpected medical expenses, giving you peace of mind as you pursue new opportunities. By registering with PhilHealth and learning how to avail yourself of these benefits effectively, you’re not just safeguarding your health; you’re also preparing for a more secure future.

Maximizing your PhilHealth contributions is vital too—every peso counts when managing finances during unemployment. This effort ensures that you’re making the most out of what you’ve put in while keeping an eye on those costs like “how much is philhealth contribution for unemployed.”

Take charge of your health journey today by utilizing all available resources through PhilHealth. Stay informed about your options and make decisions that best suit your needs as you transition into new career opportunities ahead.

Post Comment